Homeowners Insurance in and around Las Cruces

A good neighbor helps you insure your home with State Farm.

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

With State Farm's Insurance, You Are Home

With your home protected by State Farm, you never have to be anxious. We can help you make sure that in the event of damage from the unpredictable burglary or falling tree, you have the coverage you need.

A good neighbor helps you insure your home with State Farm.

Give your home an extra layer of protection with State Farm home insurance.

Protect Your Home Sweet Home

Great coverage like this is why Las Cruces homeowners choose State Farm insurance. State Farm Agent Jennifer Johnson can offer coverage options for the level of coverage you have in mind. If troubles like sewer backups, identity theft or service line repair find you, Agent Jennifer Johnson can be there to help you file your claim.

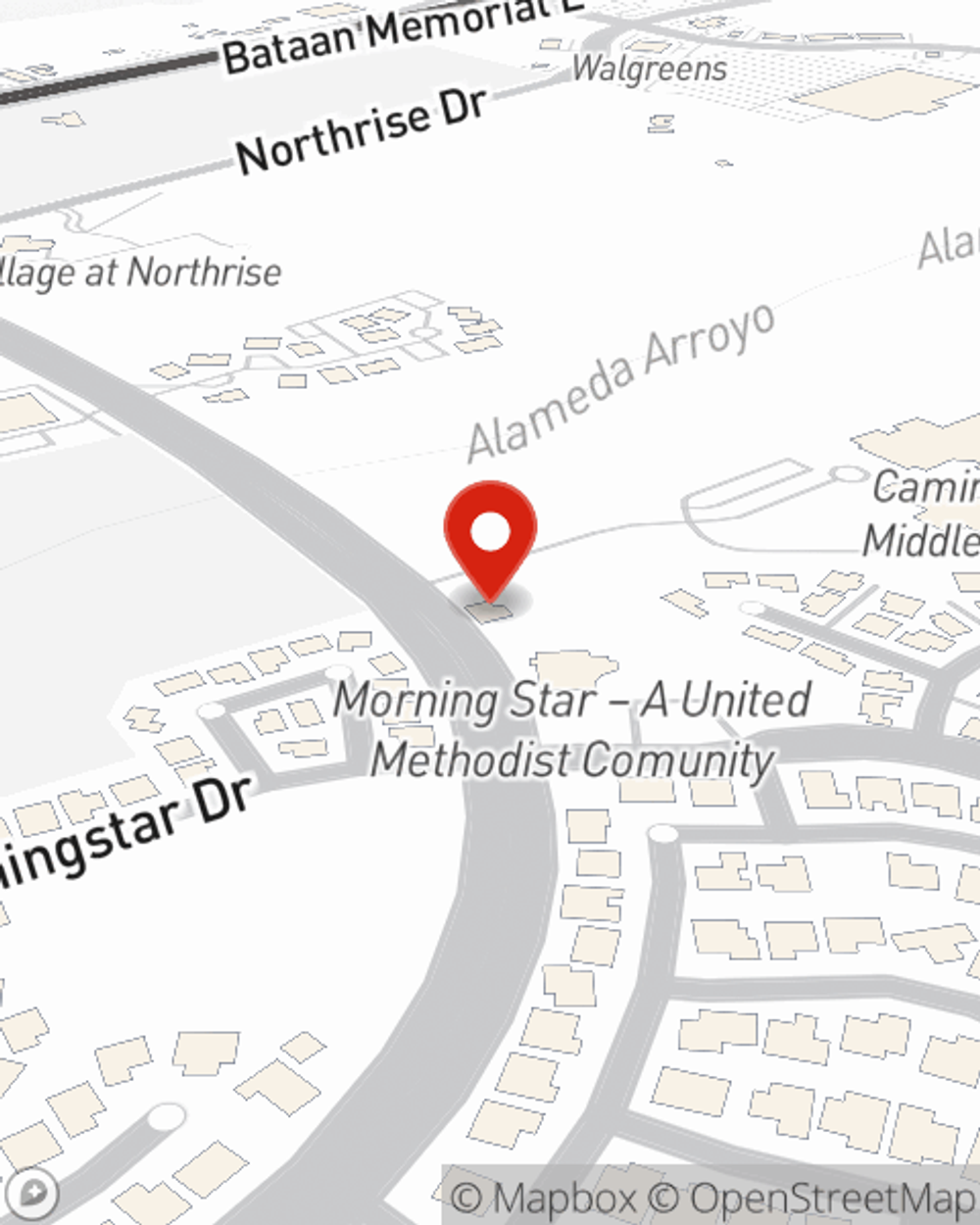

As your good neighbor, State Farm agent Jennifer Johnson is happy to help you with understanding the policy that's right for you. Stop by today!

Have More Questions About Homeowners Insurance?

Call Jennifer at (575) 524-0237 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Roof maintenance tips for your home

Roof maintenance tips for your home

Your roof is put to the test daily. Learn how to recognize the first signs of a problem inside or outside your home and when to get a new roof.

Jennifer Johnson

State Farm® Insurance AgentSimple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Roof maintenance tips for your home

Roof maintenance tips for your home

Your roof is put to the test daily. Learn how to recognize the first signs of a problem inside or outside your home and when to get a new roof.